A comprehensive study unveils surprising insights on the German market 👀

29 January 2024

In the dynamic world of German retail, where giants like Edeka, Rewe, Aldi, and Lidl compete fiercely for consumer attention, our team has been diligently working to dissect the intricacies of this market. Armed with millions of daily data points, we have positioned ourselves as the authority in providing accessible and curated retail data on every mass consumer product. This dedication to precision has not only garnered attention in the media but has also established us as a leading force in the industry.

The media buzz 📰

Our relentless pursuit of understanding the retail landscape has earned us notable mentions in prominent media outlets, showcasing the impact of our work. Here are some of the highlights:

- Frankfurter Allgemeine: Link to Article

- derwesten.de: Link to Article

- Express: Link to Article

- inFranken.de: Link to Article

- Moin: Link to Article

- Business Insider: Link to Article

Key takeaways from the study:

- Unexpected Findings in Discount vs. Supermarket Pricing: The article challenges the common perception that discounters always offer the best deals. Daltix compared prices between discounters and supermarkets, discovering that, surprisingly, supermarkets often outshine discounters in providing cost-effective options.

Focus on Private Labels: The study particularly delves into the pricing of private-label products. Edeka-Supermärkte, Netto-Discounter, Globus-Verbrauchermärkte, Rewe, and Flink emerge as the frontrunners in offering competitively priced private-label items. Conversely, discounters such as Aldi Nord and Penny, traditionally associated with affordability, are found to be comparatively more expensive.

Price Differences for Private Labels: On average, private-label products across all retailers were found cheaper than their branded counterparts. The analysis emphasizes that these differences can be even more significant for specific items. Dries de Dauw (CEO of Daltix) highlights this point, indicating that the study showcases substantial variations in prices for certain products.

Variations in Brand-Name Product Pricing: The study also compares prices of branded products in supermarkets and discounters. Globus and Edeka prove to be particularly cost-effective for identical products, while Penny and Lidl lag behind. The article suggests that, especially during Christmas shopping, exploring the no-name section of supermarkets can be financially rewarding.

Aldi Nord’s Response: Aldi Nord disputes the reliability and representativeness of the Daltix study. They argue that the database includes special offers as regular prices, creating an inaccurate comparison. Additionally, Aldi Nord points out issues with the database’s article matching for private labels, citing an example where organic yogurt was compared with regular, less expensive yogurt. Surprisingly enough, yogurt was not even in the sample for the Daltix study.

Conclusion: This study conducted at Daltix not only challenges preconceived notions about discounters and supermarkets but also underscores the complexities of pricing strategies and the importance of considering specific product categories.

Check out our free interactive demo 🪄👀

Related resources.

35 million data points: Retailers and suppliers can now use on- and offline data more efficiently

To make smart decisions, retailers need high-quality and reliable retail data. Those who have access to price, product and promotion data on a daily basis have a clear advantage. Daltix and Smartspotter are partnering and can now deliver both of their data expertise of high-quality data to Germany.

Renewed focus brings on new CEO at Daltix

As Daltix expands into Europe, it renews its focus on developing a unique product with its customers at the centre. This change has brought a new CEO to Daltix.

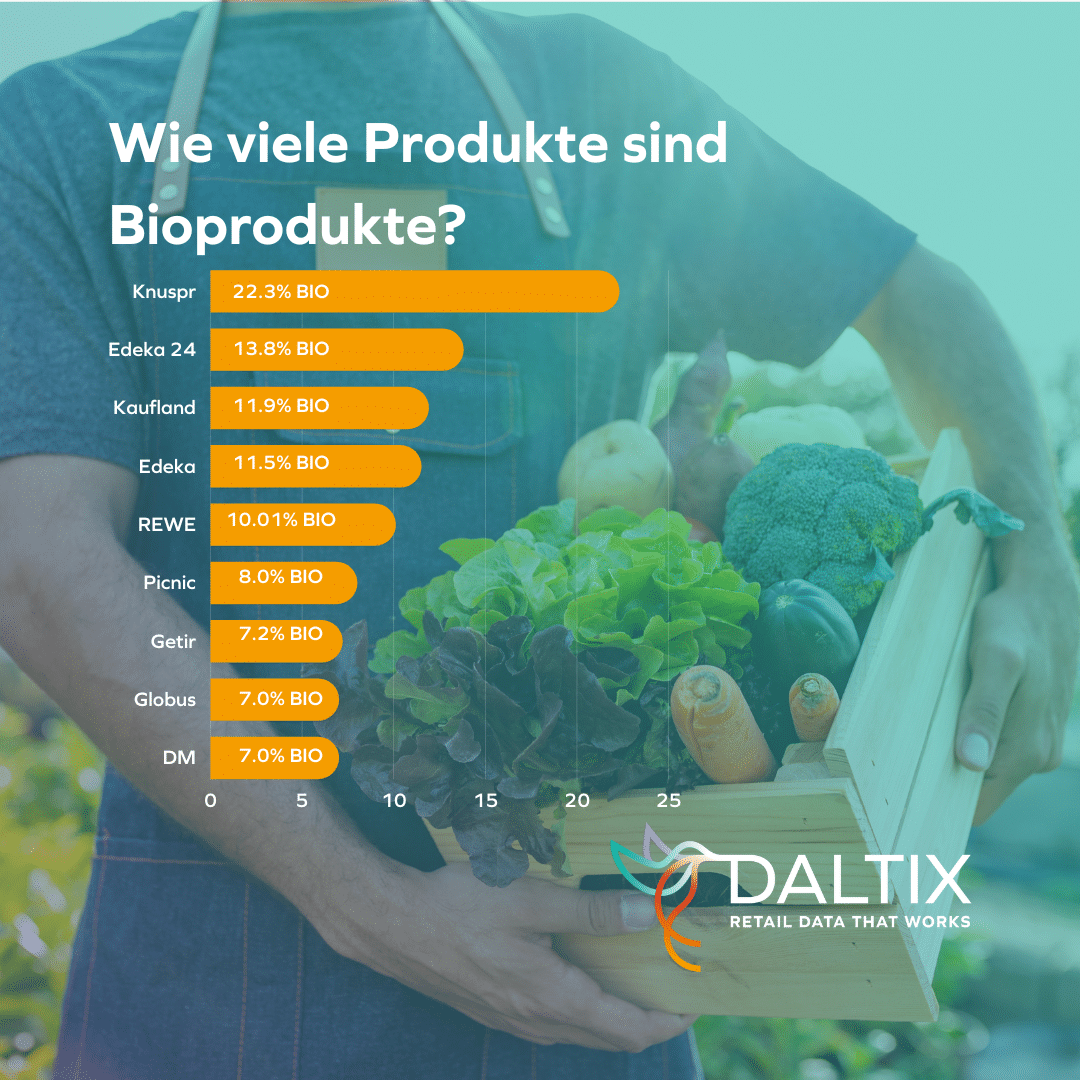

A Daltix analysis: Knuspr offers the largest share of organic products in Germany.

As part of a recent analysis, the assortments – a total of more than 216,000 products – of eleven different retailers, such as REWE, dm and Picnic were compared across Germany and the proportion of organic products in relation to the total assortment was determined. Read more about the results in this press release.